Small businesses are often victims of organised money laundering schemes. One of the major reasons behind this is their lack of understanding about Anti Money Laundering. Money laundering is a severe crime. It can also have negative long-term effects on a business. If people believe your business is linked with money laundering, you will lose customers. More importantly, authorities will come knocking on your door.

Money laundering also hampers economic growth. In 2019, a report found thousands of UK companies involved in money laundering. That amounted to £137 billion in economic damage.

We want to help you to protect your business against money laundering. You will find the following information in this guide.

Table of Contents

What is Anti Money Laundering?

Anti Money Laundering (AML) refers to all the laws, regulations and procedures intended to stop criminals from hiding illegally obtained funds as valid income. Money laundering is the process of moving illicitly acquired cash through financial systems. The aim is to make it look like it came from a valid source. Money laundering can be defined as the following –

- An underlying profit-making crime. (For instance – tax evasion, fraud, theft, organised crime, drug trafficking, embezzlement etc.)

- An act to hide, transfer or convert the proceeds of crime.

The basic concept of money laundering involves converting criminal proceeds into clean money. Dirty money is primarily used for illegal purposes, like in a major drug deal or bribe. This dirty money enters into the financial system in many ways. Most of them typically involve small deposits or transactions. That’s because small amounts do not garner much attention. Whatever technique the criminals may use, AML aims to stop that by taking proper measures.

How Money Laundering Works: The Three-Stage Process

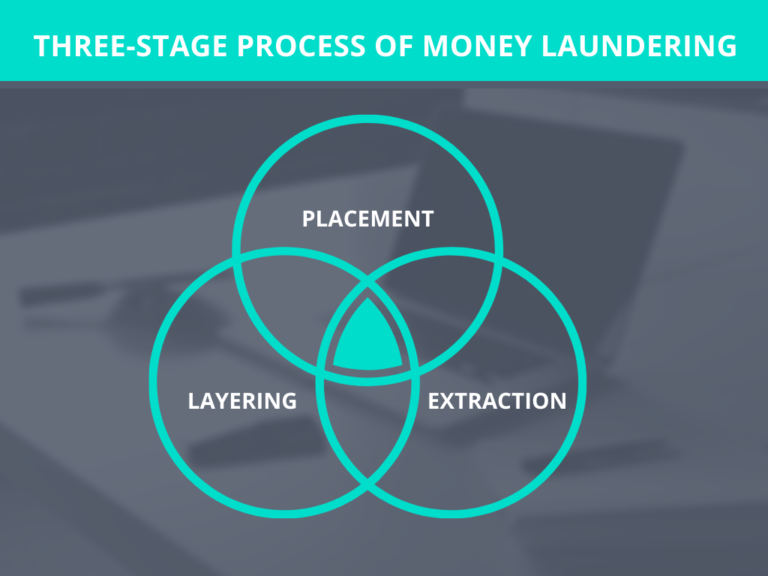

Anti-money laundering awareness requires knowledge about how money laundering works. Money laundering has one purpose. That is, to turn the proceeds of crime into legitimate and unsuspicious money. Even though Money laundering is a process, it has the following three stages.

1. Placement

Money laundering starts with the placement stage. It is the stage whereby the criminal proceeds of illegal activities enter into the financial system. The following are some common examples of placement –

Cash businesses

This requires adding the cash gained from crime to the lawful takings. It works best in business with little or no variable costs. For example – car park, strip club, tanning studio, car wash and casino.

False invoicing

False invoicing means using dummy invoices to legitimise illegal money. Nonetheless, a false invoice does not show a real transaction. Rather it is just a means of hiding the real source of money.

Smurfing

It means structuring large amounts of money into many small transactions. That too significantly below the anti-money laundering reporting threshold of banks. And then the criminals use these to pay expenses.

Trusts and offshore companies

Trusts and offshore companies hide the identity of the actual beneficial owners. As a result, dirty money turns into clean money on the surface.

Foreign bank accounts

Many people lodge in foreign bank accounts. They do so by depositing small amounts of money at a time. And then they send it back to the country of origin.

Aborted transactions

In this technique, a lawyer or accountant holds the funds in their client account. Usually, to show a proposed transaction settlement. But after a certain period, they abort the transaction. Then they return the funds to the client from an untraceable source.

2. Layering

The second stage in the process is layering. The main goal of this stage of the process is to distance the illegal money from its source. It is achieved by adding layers of financial transactions. As a result, it impedes the audit trail and cuts the original crime link. Layering is essentially the repeated use of placement and extraction. But they use varying amounts each time.

Layering conceals the source of the money by using a series of transactions and accounting tricks. The purpose is to make tracing transactions as difficult as possible. This stage is often the most complex in the whole process. Sometimes, it might involve the international movement of the funds.

3. Extraction

The final stage is the extraction or getting the funds out. The goal is to use the money without attracting attention. It means without alerting the law enforcement or the tax authorities. At this stage, the previously tainted money enters into the legitimate economy. The criminal proceeds are then fully integrated into the financial system. While also giving off the appearance of legitimacy. The final stage’s goal is to reconcile the money with the criminal in a manner which –

- seemingly does not trace back to its origins.

- gives off an illusion of legitimacy.

Some commonly used extraction techniques are below –

Fake employees

Using fake employees is a way of getting the money back without being noticed. It is usually paid in cash and then collected.

Loans

Giving loans to directors or shareholders that will never be repaid.

Dividends

Paying as dividends to shareholders of companies that criminals control.

Purchase

Extraction may include the acquisitions of businesses or properties. It may also include buying luxury items such as artwork, jewellery, or high-end cars.

One misconception of the three-stage process is that all three stages have to occur for money laundering. But that’s not the case. Each of the three stages can occur separately or overlap. However, it is essential to note that the money laundering offence will occur during each phase.

Anti Money Laundering Regulations

Anti- Money Laundering regulation aims to prevent money laundering. For example, AML regulations require banks and other financial institutions to follow some rules. Especially when they accept customer deposits or issue credits. Because these rules ensure they aren’t aiding money laundering. Anti Money Laundering laws cover a limited number of transactions and criminal behaviour. However, their implications are radical.

What is the Anti Money Laundering (AML) Legislation in the UK?

The following dictates the UK Anti Money Laundering legislation –

- The Proceeds of Crime Act 2002 (POCA)

- The Terrorism Act 2000

- The Money Laundering, Terrorist Financing and Transfer of Funds 2017

- The Money Laundering and Terrorist Financing (Amendment) Regulations 2019

Proceeds of Crime Act 2002 (POCA)

The Proceeds of Crime Act (POCA) is the UK’s primary Anti Money Laundering regulation. This Act defines the offences that constitute money laundering. Besides that, it deals with recovering illegally obtained assets. The Proceeds of Crime Act 2002 covers virtually any act that constitutes a person’s benefit from criminal conduct. Note that mere possession of the property can be a criminal activity as per this Act.

POCA aims to prevent money laundering activities in financial institutions. It also seizes criminal proceeds and stops illegal activities. Overall, it aims to minimise criminals who hide and transfer money and assets. POCA also cooperates with money laundering investigation authorities and AML regulatory agencies.

Under POCA, banks and other financial institutions must put appropriate AML controls to detect money laundering activities. These include a range of obligations, including the following.

- Customer due diligence (CDD)

- Transaction monitoring measures

- Reporting requirements

The Terrorism Act 2000

While POCA focuses on Anti Money Laundering, the Terrorism Act 2000 imposes counter financing of terrorism obligations on banks and financial institutions. However, this also includes customer due diligence, transaction monitoring and specific reporting obligations. This Act has been amended over the years as the following.

- Anti-Terrorism, Crime and Security Act 2001

- Terrorism Act 2006

- Terrorism Act 2000 and Proceeds of Crime Act 2002 (Amendment) Regulations 2007.

Money Laundering Regulations 2017

After POCA and the Terrorism Act, the subsequent most important AML legislation is

The Money Laundering Regulations (MLR) 2017 transposes the EU’s 5th Anti Money Laundering Directive obligations. The intention was to tighten controls in the private sector. Also, it introduces the need to implement a written AML risk assessment in organisations.

Some fundamental changes in the MLR 2017 are below –

- General risk assessment

- Risk mitigation policies

- Level of customer due diligence

- Politically exposed persons (PEPs)

- New criminal offence

Money Laundering Regulations 2019

The Money Laundering and Terrorist Financing Regulations 2019 implemented the EU Fifth Money Laundering Directive in the UK. It came into effect on 10 January 2020. This legislation broadens the scope of regulated industries. It also changes how customer due diligence and enhanced due diligence is conducted.

The United Kingdom is also a member of The Financial Action Task Force (FATF). The UK Anti Money Laundering legislation meets FATF’s global standards. Accordingly, it aims to stop, freeze and seize criminal proceeds.

Anti Money Laundering Requirements by Legal Authorities

The three statutory Anti Money Laundering supervisors in the UK are

- HM Revenue and Customs (HMRC)

- The Gambling Commission

- Financial Conduct Authority (FCA)

They are responsible for anti-money laundering compliance and enforcement in the UK.

The Office for Professional Body AML Supervision (OPBAS) looks over the AML supervisors in the UK. All the professional bodies are governed by The Oversight of Professional Body Anti Money Laundering and Counter-Terrorist Financing Supervision Regulations 2017

The principles of Anti Money Laundering requirements are contained in the MLR 2017 and MLR 2019. The MLR 2017 calls for relevant individuals and organisations to

- Carry out a proper risk assessment

- Implement adequate policies, controls and procedures,

- Carry out appropriate levels of customer due diligence (CDD)

The FCA handbook also requires firms to establish and maintain effective systems and controls for financial crime risk. Anti Money Laundering compliance is dealt with in senior management arrangements, systems and controls (SYSC).

Firms also need to follow guidance published by the Joint Money Laundering Steering Group (JMLSG). Because the FCA considers it while deciding whether to take actions against a firm.

Who Needs to do Anti Money Laundering (AML) Checks?

According to HMRC, the following businesses should be supervised. They must conduct Anti Money Laundering checks as well. They also must be registered with the government or overseen by a professional body.

- Money service businesses

- High-value dealers

- Any trust or company service providers

- Accountancy service providers

- Estate agency businesses

- Bill payment service providers

- Telecommunications, digital and IT payment service providers

- Art market participants

- Letting agency businesses

Check if you need to register with HM Revenue & Customs. However, your business can also be supervised by the FCA or a professional body.

What Penalty can be Issued for Money Laundering?

The principal money laundering offences are punishable under the following acts

- The Proceeds of Crime Act 2002

- The Terrorism Act 2000

Offenders are punishable up to 14 years’ imprisonment, a fine or both.

How to Protect your Business from Money Laundering?

You may think that your small business would never play any role in such illegal schemes. But you’d be surprised to know it’s more common than you think. However, it is possible to protect yourself and your business. You have to be extra careful and take necessary precautions. Some ways to protect your business from money laundering is given below.

- Know your Customers

- Anti Money Laundering Training

- Compliance with Anti Money Laundering Regulations

- Be more Careful with Prepaid Credit Cards

- Investigate Suspicious Transactions

- Establish a Formal Anti Money Laundering culture

- Beware of cybersecurity risks

- Automated compliance

1. Know your Customers

It is important to know who your customers are and what drew them to your organisation. Because you can never be too careful when it comes to your business. Before completing a transaction, it is crucial to ask, is this a typical transaction? or is there something unusual? If you run a small business with large transactions, you are likely to be more at risk.

When dealing with large purchase or investment, document the source of money. Also, complete a background check before accepting investors. Most importantly, pay attention to transactions that seem suspicious or irregular to you. Often businesses overlook unusual stipulations for fear of losing a high paying customer. Often they do so in favour of a fat cheque. Make sensible choices and avoid falling into this trap.

2. Anti Money Laundering Training

There are numerous money laundering techniques that criminal minds use. Therefore, it can be challenging to know about all the potential tactics and stay updated. Nonetheless, when you educate yourself about some common tactics, you will notice them quickly. Some of the more common techniques involve the following:

- Making payments using wire transfers

- Using financial instruments to layer or hide the money

- Over-billing

- Falsifying invoices

Some other efforts may also be used to hide corrupt money.

To be on top of the relevant and latest AML, you can take this Anti Money Laundering (AML) Training. To protect your business from money laundering, you must stay up-to-date on AML. Training is one of the most effective ways of protection against money laundering.

3. Comply with Anti Money Laundering Regulations

One of the most effective ways to save your business from money laundering is abiding by AML laws. You can use this AML compliance checklist. This will make sure you efficiently protect your business. It will also save you from becoming a facilitator of criminal activities.

4. Be more Careful with Prepaid Credit Cards

Using Prepaid credit cards for making payments is common. Unfortunately, many criminals also use prepaid cards to hide tainted money. Mostly because they are not heavily monitored and are relatively anonymous. Consider it a red flag if you notice the same customer making large purchases with prepaid credit cards. The banking system may not monitor prepaid cards usage actively. But you can report suspicious activity to the authorities.

5. Investigate Suspicious Transactions

If you come across anything suspicious, make sure to check for further discrepancies. While many people make large cash purchases for legitimate reasons, some don’t. For example, some people may prefer to keep ‘mattress money at home. However, when asked about them, vague answers to your questions should raise suspicion. In addition, find out why they are making a large purchase and the source of money. For instance, do they have a justifiable need for your products or services?

While dealing with a significant cash transaction, due diligence might be in order. For example, did the individual’s background check came up clean? Is the company registered in the origin country and financially sound? A smart deal has clean participants and where both sides will legally benefit.

6. Establish a Formal Anti Money Laundering culture

Take a more proactive role when it comes to AML. Instead of merely advising your employees to educate themselves about money laundering. For example, you can develop an Anti Money Laundering policy for your company and implement it company-wide. (See more on Anti Money Laundering policy below). Or you can also provide Anti Money Laundering (AML) Training for your employees. You must follow through with its learnings as well. Engrain the training outcomes in your organisation culture and everyday activities.

7. Beware of Cybersecurity Risks

With the increase in financial crime and cloud-based activities, it is essential to ensure cybersecurity. The cyber activities must be monitored along with living transactions. Criminal’s creation of multiple online identities for illegal transaction purposes. When dealing with large online transactions, it is crucial to research the purchaser or investor. That too in the same way that you would with in-person transactions.

Unfortunately, the internet has exponentially expanded the capabilities of money launderers. It is even more difficult to detect illegal transfer of money through these given below:

- Online banking

- Anonymous payment services

- P2P transfers

- Cryptocurrency

This increases cybersecurity risks significantly. Moreover, avoid sharing financial information with anyone you are not familiar with. This will protect your business further. Invest in the best security practices and products. Don’t forget to change passwords regularly. You can also use anti-money laundering software programs. Many programs are customisable so that they are appropriate for small businesses as well.

8. Automated Compliance

Achieving compliance with UK Anti Money Laundering regulations requires significant administrative effort and large amounts of transaction data analysis. You can automate AML processes with a range of smart technology tools. This will help you to avoid human error and possible compliance penalties. Most importantly, automation will increase speed, accuracy and efficiency in Anti Money Laundering. It also allows firms to adapt to new regulations and continue to deliver the highest standards of compliance.

Anti Money Laundering Policy

The aim of the anti-money laundering policy is to prevent money laundering from taking place. Anti Money Laundering policy also provides directives on what to do when money laundering activity is suspected. It is crucial to have an Anti Money Laundering policy in place for better protection. Such a proactive act might be just what your business needs to prevent money laundering.

Before you make an Anti Money Laundering policy for your organisation, you should know what to include in an AML policy. An effective Anti Money Laundering policy should involve the following measures –

Anti Money Laundering Program

An AML compliance program should be put in place. It must include customer due diligence and transaction monitoring measures. Anti Money Laundering program should also screen for politically exposed person (PEP) status and sanctions lists per regulatory obligations.

Reporting Obligations

Organisations must submit suspicious activity reports (SAR) to the National Crime Agency when potential money laundering activity is detected. It should be clearly mentioned in the policy when to report it and how to report it.

Money Laundering Reporting Officer

An individual must be appointed as the Money Laundering Reporting Officer (MLRO). The officer will oversee their firm’s Anti Money Laundering compliance program. The MLRO should have sufficient authority and knowledge about it to carry out their duties effectively.

Anti Money Laundering Training

An organisation should ensure its employees have the knowledge and resources they need on AML. They should have an ongoing training schedule on Anti Money Laundering (AML) Training so that they can anticipate upcoming regulatory changes.

Closing notes

Money laundering is a significant risk for businesses today. Because dirty money can aid many crimes like child trafficking and drug business. In addition to facing possible criminal charges and monetary fines, it can damage your business reputation. However, these penalties may be imposed regardless of whether your involvement was accidental or intentional. Thus, you should be proactive about protecting yourself against money laundering risks. Anti Money Laundering (AML) Training can help you stay safe and protect your business.

Learn More

- Available Courses

- Healthcare144

- Mandatory Training9

- Administration & Office Skills2

- HR & Leadership2

- Charity & Non-Profit Courses26

- Job Ready Programme34

- Animal care10

- Law11

- Quality Licence Scheme Endorsed112

- Teaching16

- Teaching & Academics Primary29

- Accounting & Finance Primary37

- Training5

- Design23

- IT & Software196

- Health and Safety440

- Marketing34

- Career Bundles142

- Construction53

- Electronics30

- Hospitality27

- Health and Social Care259

- Child Psychology39

- Management394

- Business Skills286

- First Aid75

- Employability271

- Safeguarding76

- Food Hygiene107

- Personal Development1423

Food Hygiene

Food Hygiene Health & Safety

Health & Safety Safeguarding

Safeguarding First Aid

First Aid Business Skills

Business Skills Personal Development

Personal Development